Large companies like Domino’s, Starbucks, Panera and Chipotle are envied for their ability to invest massive investments in technology, especially in terms of customer engagement and loyalty. Not everyone is so fortunate.

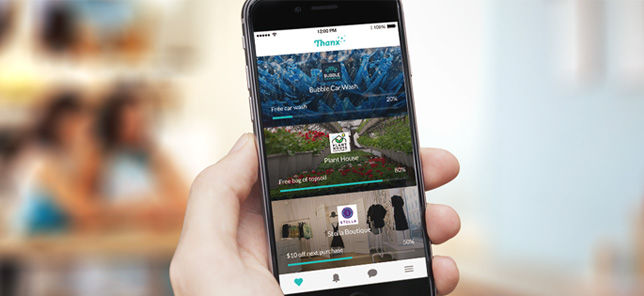

But now Thanx CEO Zach Goldstein, who has a background working with large-scale restaurants and retailers at Bain & Company, is providing smaller restaurants with resources to maximize the lifetime value of their best customers and compete with the same weapons employed by the world’s largest chains.

“You’ve seen the legacy players who are still operating very much the old way, and they are dying,” Goldstein said of the gulf between innovative brands and those that haven’t caught up with the times. “It’s our role in this ecosystem to try to help businesses that are small and large who have not successfully made the leap to being data driven and digitally enabled.”

With a knack for the dramatic in describing how his eight-year-old CRM and customer-engagement company fits into a fast-changing restaurant landscape, Goldstein and his 40-something employees suddenly find themselves in the right place at the right time as big-brand tech filters down to smaller brands.

“Restaurants are, for the first time, seeing disruption at the pace of other industries, and the parties that are bringing that pace are the third-party delivery companies,” which he described as wolves in sheep’s fluffy clothing. “That is pushing restaurants to have to move more quickly. So was this the direction when we started Thanx as we saw things evolving? Yes, absolutely. Has it taken longer? Yes.”

Boiling his point of view down further, Goldstein says that many restaurants are focusing on things that “check the box” in terms of having a decent mobile application or loyalty program, but his experience has shown that “neither of those drive much revenue.”

Hearing that sentiment, one might wonder if the execs at Domino’s or Chipotle would agree, but the CEO and co-founder went onto explain that the difference between only-decent apps and loyalty programs means everything. The devil—or in this case, steadily improving traffic and sales volume—lies entirely within the details.

“I can’t tell you the number of businesses we talk to who tout the success of their reward program by how many people have signed up—it’s the most utterly meaningless metric I’ve ever heard,” Goldstein added. “It’s not about how many people sign up. It’s about how are those people engaging with your brand and is your personalization able to drive those people to make more purchases with your brand. If you’re not measuring that, it’s a waste.”

Backing up his passionately delivered claims, Goldstein points to regional chains with five, 10 or 15 locations that outsourced the creation of digital apps that have sub-par ratings, which he said is a huge turnoff as more hungry customers migrate to online channels. Beyond those ratings, he added, it’s more important than ever for unit-level profitability to convert third-party customers into proprietary, in-house ordering pathways that have no percentage fees to contend with.

Pressed for evidence that it’s possible to convert third-party customers, which is the current focus for many restaurant leaders, Goldstein said he’s worked with several restaurants that are stealing share back from the DoorDashes and Grubhubs of the world.

His top priority for restaurant operators is making sure ordering through direct restaurant channels is just as frictionless and pleasurable as the national delivery players. Second, he noted, is giving customers clear incentives to order directly through the restaurant, which, he clarified, means increasing prices for third-party channels.

“One customer we work with, their volume or revenue that went to third-parties declined by 50 percent when they started allowing delivery to be initiated through their own website,” Goldstein said. “That’s a big difference.”

That focus on revenue, over order volume, is the key as Thanx and many other brands look to help restaurants improve profitability as more orders leave the restaurant in a bag, box or insulated pouch.

While unit-level profits are by far the most important consideration for restaurants of all sizes, he noted that many restaurants are still focused on volume and traffic counts, which he posited is fuel for a perfect storm of unprofitability further down the line.

Beyond basic concepts, Thanx helps restaurants proactively identify VIP customers and then monitors their “churn” so a restaurant can step in and directly market to customers who’ve reduced their order frequency patterns—whether that’s reaching out to ask if they had a bad experience or sending them with a custom-built, limited-time offer.

“That’s what modern lifecycle marketing looks like,” he said, noting that approach is “the exact playbook that Chipotle used to grow to a billion dollars of digital revenue.”

One of several important qualities in Thanx-built apps is the ability to identify customers solely through their credit cards, so they don’t have to use their phones or external hardware to scan codes or jump through other hoops, which is something he said is all too common and a “bad precedent” set by Starbucks—even though it’s often considered best in class.

While Goldstein touted a focus on smaller and mid-size restaurant chains, Thanx also works with larger “enterprise” brands, which have even more incentive to build and maintain successful apps and rewards programs due to their scale. Some of its clients include Pincho, True Food Kitchen, Oath Pizza, Tommy Bahama and Pacific Catch, among others.

Asked about pricing, Goldstein said “it varies widely, so it’s really hard to quote a number,” but said that Thanx is a “premium-priced product” relative to competitors, but he added that paying less for such important technologies won’t be worth it in the end when customers start walking away or restaurant managers are unsure if their digital approach is actually driving revenue instead of just volume.

Above all, he said, the goal is to fully commit to shifts in consumer behavior, and to maintain those investments long after plunking down that first stack of cash.

“It’s remarkable to me the number of brands who would never tolerate a three-star review on Yelp, but who tolerate a two-star app rating,” he said. “If a restaurant is seeing an app that is 3.5 stars or lower, your customers are already telling you there’s a problem.”