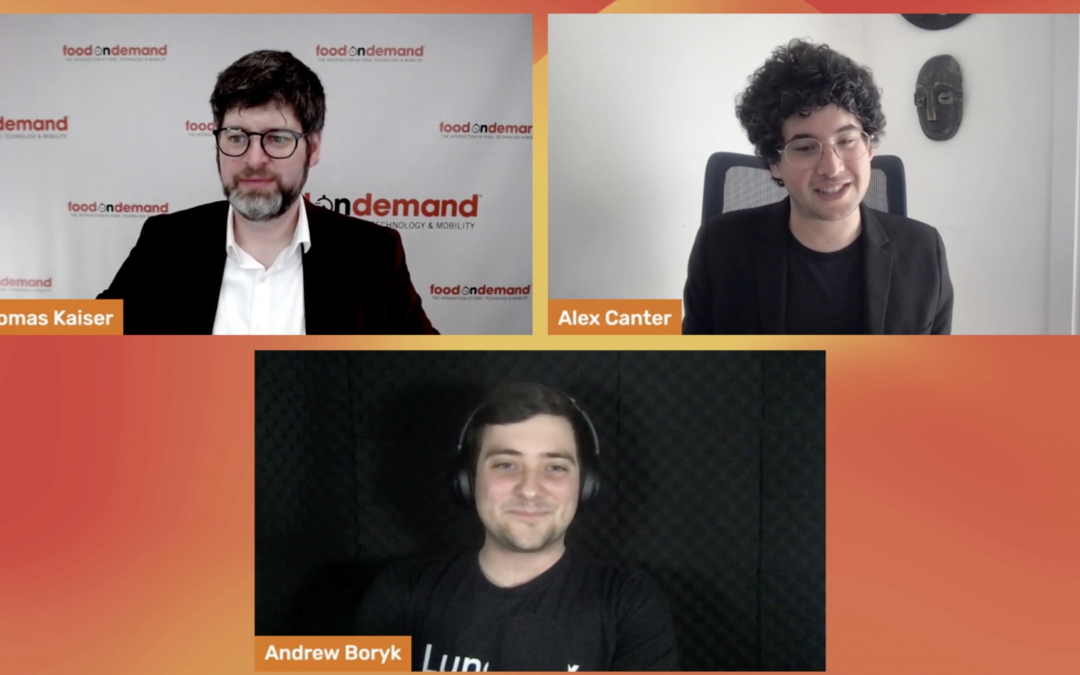

During the second session of Food On Demand’s Building Your Off-Premises Tech Stack event, Ordermark CEO Alex Canter and Lunchbox CTO Andrew Boryk joined FOD Editor Tom Kaiser for an update on digital ordering after years of massive changes in the restaurant scene. Covering native delivery, ghost kitchens, software integration and virtual restaurants, the three sized up the industry’s technological offerings after a year of pandemic-induced progress.

Founded in 2017, Ordermark helps restaurants adapt to what Canter called its e-commerce phase that he said is “happening before our eyes right now.” With so many restaurants having underutilized capacity in their operations, he said his company’s highest priority is bringing them additional volume and incremental orders.

Registration is still available for anyone looking to watch sessions for the Building Your Off-Premises Tech Stack event.

Ordermark’s delivery integration software is a key part of that mission, but its Nextbite virtual restaurant startup is another major component, with Canter adding that “helping them turn on an extra 10, 20 or 30 orders per day out of their existing infrastructure is … the most impactful thing we can be doing for restaurants at this time.”

Two years newer than Ordermark, but already an outspoken industry provider of online ordering integrations and both delivery and native ordering marketing campaigns, Lunchbox was founded in 2019 with an attention-getting marketing message aimed at breaking restaurants’ dependence on third-party delivery providers.

“We saw these third-party fees, we saw the lack of control over customer data for restaurants and we started Lunchbox with the intent to help convert that traffic and help restaurants grow that experience and that relationship they have with their customers and grow their own first-party system in a way that’s actually profitable for them,” Boryk said. “We have 40-plus integrations to date, including Ordermark, and it allows restaurants to take all the things they know and love and look at it at one place and consolidate on one platform.”

With more than 1,000 restaurants using its platform, Boryk said the biggest progress his team has seen over the last year is awareness among operators about the need for online ordering and the realization that, with dining rooms shut down, they urgently need to prioritize first-party ordering to lessen the impact of third-party delivery commissions. He added that consumers have also gained awareness about the importance of ordering directly to support all restaurants, regardless of size, during this time of need.

Canter agreed in concept, but said that his experience as a restaurant operator himself—Canter’s Deli in Los Angeles—has shown that it’s both expensive and difficult to switch customers from the delivery apps they’re familiar with and have their credit card information stored in. Even though his family business is familiar with the common tactics of converting third-party customers to in-house ordering streams, Canter’s has only been able to move 4 percent of its digital customers over from third-party channels.

“Even to get to 4 percent was a struggle,” he said. “In practical reality, only your top percentile of loyal customers are the ones who are going to actually have your mobile app as a restaurant … instead of trying to focus on strategies to help our restaurants convert more of their orders over, we’re just trying to generate more orders for them, and creating virtual brands and restaurants is a great way to allow restaurants to meet different consumer groups, service different types of audiences out of their same existing kitchens where restaurants don’t have to think about in-app promotion, SEO and driving that digital market awareness.”

Boryk countered that Lunchbox has an 80/20 goal for its clients, seeking to reach 20 percent of digital orders coming in through native channels. Thus far, he said its partnered restaurants have actually reached 46 percent native orders on average.

“That’s sitting great,” Boryk said. “It’s not about cannibalizing, it’s about growing those third-party channels and using them to consistently advertise as a marketing tool for awareness and building promotion, whether it’s using those third parties, using Yelp or using other systems, knowing how to use them effectively” to shift customer ordering habits.

Canter said some commonly discussed strategies to convert third-party customers to native channels violate contractual terms of service with delivery providers, which is something his family’s restaurant has been careful to abide by. Instead, Canter’s Deli has focused on improving third-party economics by removing menu items with high food costs and raising menu prices for third-party marketplaces between 5 and 10 percent—which he said most delivery providers are “actually OK with now.”

He also said operators shouldn’t overlook the unique costs that come from native deliveries, including paying for the last-mile delivery, whether that’s using in-house drivers or outsourcing via local couriers.

“There’s still some associated costs that are from the marketing spend and whatever else is going into acquiring that customer, so it’s not as big of a gap as I think everyone thinks it is,” Canter said about native delivery compared to third-party. “There’s still those fees associated with it when someone’s ordering on your website, so the answer is both, we’re trying to maximize both our order volume internally on our own direct channel and also appear as high up on the search engines of these platforms and really maximizing that digital real estate strategy.”

Asked how restaurant operators should evaluate the many new service providers and product pitches coming their way, Boryk said that there should be a balance between determining the most important key performance indicators for the business, as well as determining what software or technology or marketing platforms already are in place that are working well.

“Let’s say you’re using Ovation for customer feedback and that’s really working and helping out,” he said. If you’d like to keep using that service, Boryk suggested asking a potential vendor how willing they are to work with that existing component, as well as logistics compatibility for current or existing business formats, whether that’s delivery fulfillment via DoorDash drive or an agnostic last-mile delivery provider like Relay.

With so much of the restaurant industry being so new and fast changing, Canter said there are “no best practices to learn from that are older than a year or two,” especially when it comes to ghost kitchens, virtual restaurants and the software required to integrate such formats into existing restaurant operations.

“It’s so wild west as far as I’m concerned from the virtual restaurant world. It becomes increasingly important to look at integration…as you start to layer more complexity into the business, so it’s still very early days in this space,” he said. “There’s a huge learning curve to understanding the strategies of optimizing the promotions and marketing and everything that goes into making sure that these universal menus are actually going to get orders, especially as it gets more and more crowded, so that’s a big area of focus for us as an organization.”

Click here to register and check out the full Digital Ordering Update session, as well as the other panels that are part of the Building Your Off-Premises Tech stack event.