New data shows that COVID-19 is potentially “even-ing the playing field” for third-party delivery. That’s according to Sense360, the data and analytics firm that measures foot traffic, proprietary survey data and gleans insights from the payment data of 5 million consumers.

In a recent look at sales through the end of March, the company saw some interesting patterns as foodservice broadly finds a new normal. In total, people covered in the panel of customers are spending 18 percent more on delivery than they were last year. Prior to COVID-19, users were spending 15 percent more year-over-year, according to the company.

That means there hasn’t been a dramatic surge in delivery, likely for a few reasons. Olivia Watson, marketing lead and author of the company’s research releases, wrote that one key contribution to the lack of a dramatic surge is the shift in dayparts. With most people who would typically order at work now homebound, there’s less of a need for delivery when the pantry is a room away. The economic distress and the unknown economic future has also pushed people to be more value conscious.That goes for restaurants too, they’re investing less in promotions on the platforms and promoting self-delivery as they are relegated to off-premises operations only across most of the country.

Sense360 notes that transactions are up, but potentially customers are ordering more than one meal, or larger meals that can feed them for more than the typical single lunch. Spending is up 16 percent even while transactions have fallen by 46 percent at restaurants.

There has been, however, a dramatic surge in grocery traffic, which suggests lost restaurant traffic is moving toward delivery—but in the grocery channel.

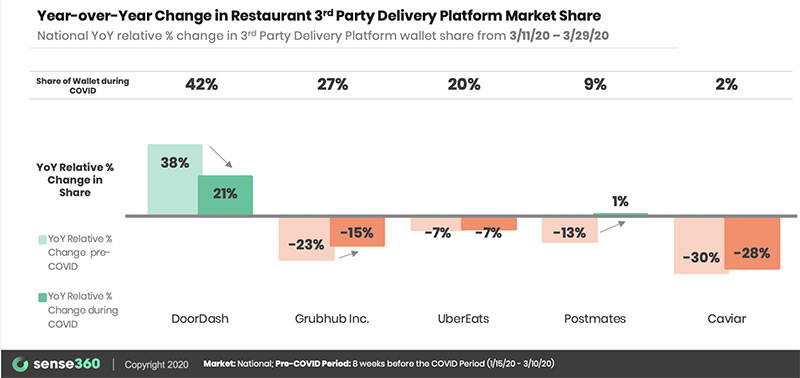

One notable effect of COVID-19 spending shifts is that it seems to be reversing the market-share trends seen earlier in the year and late last year. Prior to COVID, DoorDash was gobbling up market share. Before the pandemic hit, DoorDash was up 38 percent as a share of spending within the customer base Sense360 examines. That share has fallen to less than half, now 21 percent.

The rest of the big five have pulled some of that share back. Grubhub is down 15 percent, but that’s a positive move from before the pandemic when it was down 23 percent. UberEats is down 7 percent, flat with its pre-COVID share. Postmates has really surged on a comparative basis, growing to 1 percent of third-party delivery spending, up from a 13 percent share decline. The company’s practice of delivering more than just food has likely benefitted from the dramatic increase in grocery and C-store spending.

The company explored a few other trends in the sales data, which you can check out here.