If you’re Uber, Grubhub or DoorDash directing a huge fleet of delivery drivers or a restaurant with a lean-and-mean in-house delivery team, you have a vested interest in making sure your drivers are as safe as possible. Whether it’s causing an accident or just being a jerk on the roads, a bad driver can jeopardize a brand’s goodwill or endanger the lives of customers.

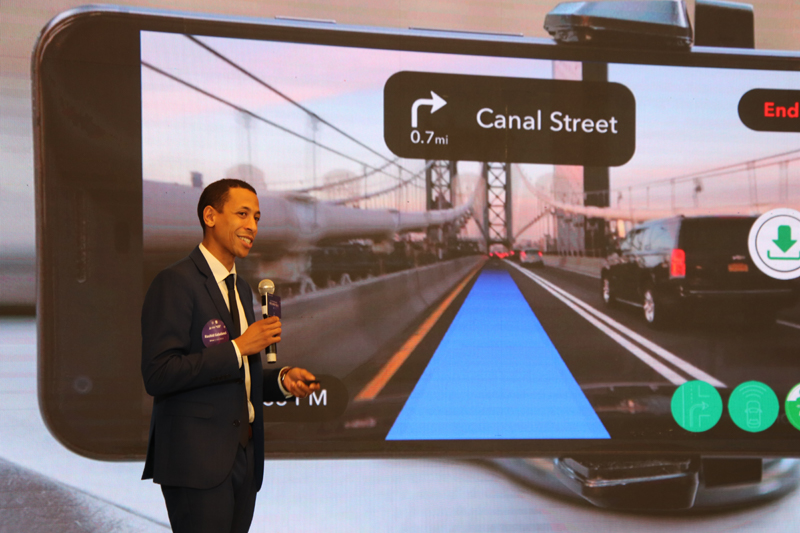

With a goal of preventing accidents in delivery cars without built-in collision avoidance technology, the free Driver app from Driver Technologies’ uses everyday smartphones to allow couriers to record and navigate their trips while receiving on-the-spot alerts about potential hazards, like jaywalking pedestrians, cars drifting out of their lane or even drivers falling asleep or not paying attention.

Founded by Rashid Galadanci, a former software investor with a special interest in brands providing a social benefit, his new Driver app is largely a product of his personal obsessions and professional background. Galadanci spent part of his formative years in Nigeria, a country with a reputation for crazy drivers, and refers to himself as a 34-year-old on his third Volvo—a car brand long known for its bleeding-edge focus on safety.

As he builds support for his safety-minded app, Galadanci sees a special application for commercial drivers of all kinds, including the gig-powered worlds of Uber and Lyft drivers, as well as all those meal delivery drivers speeding between kitchens and front doors.

Having paid attention to the self-driving trials and victories at Tesla, Galadanci said he quickly realized “the marketing spiel coming out of Silicon Valley was total BS in terms of timeline.” That gap illustrated an opportunity to use the cell phones we all carry to provide 99 percent of the capability of hardware-based collision avoidance tech for 1 percent of the cost—possibly his own veering off into the land of marketing hyperbole.

Even as automatic braking, lane-keeping and pedestrian avoidance systems go mainstream, the Driver app is aimed at the majority of new or existing cars that can’t watch, evaluate and stop for themselves. Zeroing in on professional drivers in specific, Galadanci said conversations with hundreds of Uber drivers showed they couldn’t “even afford a $250 dash cam,” which is critical in determining commercial liability after a crash.

“Meanwhile, these same Uber drivers have four phones mounted in their cars, and they’re playing the game of running Uber and Lyft and Juno all at the same time, so that’s when we started thinking what if we put an app together that does what a dashcam does, but has the safety features of a Tesla and using computer vision to look out for cars and pedestrians and cyclists … and then potentially also monitor the driver for drowsiness and distraction,” he added during an exclusive interview with Food On Demand.

Like many high-tech advancements offered for free, there’s a larger big play lurking under the veneer of altruistic safety and social do-goodness, including possible driver-safety interest from insurance companies. With more time, development and experience under its belt, Driver intends to market its app to a general consumer audience, similar to how early GPS devices quickly filtered from big-rig drivers down to the masses.

A early-stage company that currently has “thousands of active drivers,” Driver says its user base is doubling every quarter with scant advertising, suggesting to its leaders that the value proposition is clear—not just for employers of delivery fleets, but also for the insurance companies seeking to connect real-time driver performance to rates in the forms of discounts, rather than rate hikes.

With popular apps like Waze and Google Maps already ruling the roads in the U.S., Galadanci acknowledges there are competitors on the horizon, but clarified that he doesn’t see either brand jumping into the space, given their established, already-successful business models.

“Our goal is to be lean and mean and quick and move faster than the big guys, and then be an appealing acquisition for them as opposed to something they want to start building from scratch,” he added.

Whether it’s attracting investors or potential M&A buyers, both of which are de rigueur in the delivery space, Driver’s motives are as clear as its altruistic goals. Since there’s no slowing down the creeping influence of big data on things like insurance rates, it’s at least reassuring to know that overworked delivery drivers racing against the clock have an angel watching the road over their shoulder.