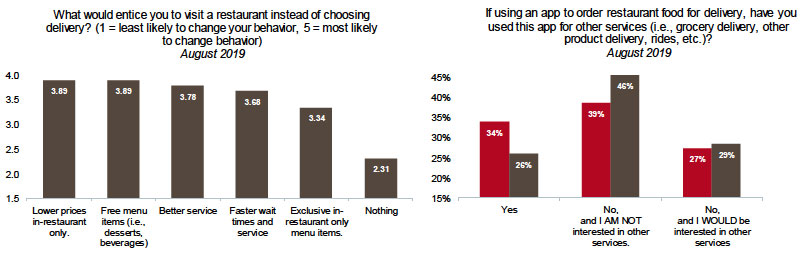

In the fourth installment of its food delivery survey, Wells Fargo surveyors asked 575 delivery customers what would drive them back into a restaurant for an in-store visit. The somewhat hilarious answer? Lower menu prices and free menu items. Yes, that ought to do it. How about free vodka tonics?

OK, while it’s easy to paint with a broad brush and laugh at that one, Wells Fargo analysts Jon Tower and William Miller were specifically asking about exclusive, in-restaurant-only menu items that came in as the second most prevalent response after lower prices.

“What this suggests is that (a) there’s pricing power in the delivery channel relative to in-store and (b) if restaurants view delivery as a long-term sales opportunity there may be a need to split menu prices in order to preserve (or grow) in-store traffic over time,” the study read.

The analysts went on to suggest that cross-cutting the data to differentiate between the lowest frequency delivery users and those with higher frequency should be a key focus for restaurants looking to grow both dine-in and off-premises traffic.

Their findings also cut in a different direction, with responses suggesting that overlap between the big third-party delivery services appears to be fading “as new customer acquisition tactics slow relative to previous periods.”

With four months of perspective, the study’s authors posit that stable delivery frequency and other trends means there could be “a significant shift in the landscape” to alter customer order behavior thru exclusive pricing, menu items or deals through delivery apps. Free delivery deals and restaurant-specific discounts have become a major part of the delivery landscape as the biggest providers like DoorDash, Grubhub, Uber Eats and Postmates compete in a brutal war for market share.

Looking deeper at the lowest frequency delivery customers compared with moderate and heavy users, Wells Fargo found that the most infrequent customers were moved by promotions or coupons as the highest motivating factor for use of an app. Medium users were more moved by the availability of restaurants, even though promotions and coupons still ranked highly. That was a similar finding for the heaviest delivery users in the study, with the authors noting that delivery fees are still important for heavy users, even as the restaurant mix was even more important compared with occasional users.

Somewhat curiously, 46 percent of respondents in August said they were not interested in other services, like grocery delivery or rides, from their delivery providers. That’s a notable increase from July, when only 39 percent of responds answered “no.” With delivery providers looking at everything from weed and liquor to dry cleaning and dog food, it’ll be interesting to see what eventually goes mainstream beyond food. So far, it’s not meal kits or groceries.