Seven years after its founding, DoorDash filed its Form S-1 with the U.S. Securities and Exchange Commission today signaling its imminent intent to become a publicly traded company. This is a significant milestone for the San Francisco-based company and the delivery industry as a whole, finally providing a look inside the economics of the largest U.S. delivery provider by market share.

After eight months of the COVID-19 pandemic, which shifted a huge share of restaurant traffic to delivery, drive-thru and takeout channels, DoorDash is looking to strike while the iron is hot in the wake of Pfizer’s upcoming vaccine announcement earlier this week. If a vaccine rollout eventually leads to a return to more typical consumer behavior, the company could be going public at the best possible moment.

After eight months of the COVID-19 pandemic, which shifted a huge share of restaurant traffic to delivery, drive-thru and takeout channels, DoorDash is looking to strike while the iron is hot in the wake of Pfizer’s upcoming vaccine announcement earlier this week. If a vaccine rollout eventually leads to a return to more typical consumer behavior, the company could be going public at the best possible moment.

DoorDash reports that it has 18 million customers, 390,000 merchants and one million Dashers, its term for delivery drivers, across the U.S., Canada and Australia. To date, the company has delivered more than 900 million orders since its founding.

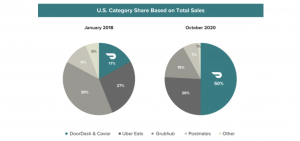

According to its prospectus, DoorDash has grown to capture 50 percent of the U.S. delivery market by total sales including its Caviar subsidiary, which it purchased from Square for $410 million in 2019. Those numbers put DoorDash far ahead of Uber Eats at 26 percent, Grubhub at 16 percent and Postmates at 7 percent. Its shares will be listed on the New York Stock Exchange with “DASH” as its symbol.

Those market share numbers are similar to estimates from research firm Second Measure, which claims DoorDash has 49 percent of the U.S. delivery market, compared to Uber’s 22 percent and Grubhub’s 20 percent.

During the nine months of 2020 ending September 30, DoorDash generated $1.9 billion in revenue with a net loss of $149 million. For those same nine months of 2019, it generated $885 million of revenue and posted a loss of $533 million.

Looking onward and upward, in the words of co-founder and CEO Tony Xu, DoorDash said it had recently made substantial investments in sales, marketing and promotions to attract new customers. The S-1 also highlighted operational and technological enhancements to improve the efficiency of its platform while lowering its cost structure.

“In the near term, we expect to continue to make substantial investments to increase consumer adoption and extend our leadership,” the prospectus read. “We believe that our business will be successful and sustainable in the long term as our business model becomes more efficient, through increasing scale and continual operational improvements, and as our sales and marketing and promotions investments normalize.”

“In the near term, we expect to continue to make substantial investments to increase consumer adoption and extend our leadership,” the prospectus read. “We believe that our business will be successful and sustainable in the long term as our business model becomes more efficient, through increasing scale and continual operational improvements, and as our sales and marketing and promotions investments normalize.”

That statement suggests the ongoing war for market share and frequency will continue as DoorDash continues its lavish spending on subsidized deliveries to spur revenue growth in the near to medium term.

Citing numbers from Euromonitor International Limited, DoorDash said Americans spent $1.5 trillion on food and beverages during 2019, of which $600 billion was spent on restaurants and other consumer foodservices.

“Over time, restaurants have benefitted from a shift away from cooking at home towards dine-in or delivery meals from restaurants, which has resulted in an increase in sales by restaurants,” DoorDash said.

Of course, that conclusion avoids the significant tension that has grown between restaurant operators and third-party delivery platforms in general. With most delivery providers charging merchants 25 to 30 percent of each order, many restaurants and industry advocacy groups have said the economics are unsustainable over the longer term and are actively contributing to the countless restaurant closures that have continued throughout the COVID-19 crisis.

Once again citing Euromonitor International, DoorDash said off-premises consumption grew to 50 percent of the total American foodservice market during 2019, for a total of $302.6 billion. Those numbers have surely grown throughout 2020, which has been a catastrophic year for restaurant operators across the U.S. and other countries that have been significantly impacted by the virus.

Once again citing Euromonitor International, DoorDash said off-premises consumption grew to 50 percent of the total American foodservice market during 2019, for a total of $302.6 billion. Those numbers have surely grown throughout 2020, which has been a catastrophic year for restaurant operators across the U.S. and other countries that have been significantly impacted by the virus.

“Fifty-eight percent of all adults and 70 percent of millennials say that they are more likely to have restaurant food delivered than they were two years ago, and we believe the COVID-19 pandemic has further accelerated these trends,” the prospectus read. “We believe the improving value proposition of local logistics platforms, including DoorDash, with wider selection than ever before, increasing convenience, and lower consumer fees has contributed to increasing off-premise consumption, and we expect this trend to accelerate, particularly in today’s convenience economy.”

The company added that suburban markets and smaller metropolitan areas have seen “significantly higher growth” compared to larger metro areas, which were earlier adopters of restaurant delivery. DoorDash predicted further international expansion beyond Canada and Australia “to build on the massive market opportunity that is already available to us.”

In a letter from Tony Xu, the CEO shared the story of immigrating from China to the U.S. as a child, his mother’s history working three jobs a day for 12 years, including as a server at a local Chinese restaurant, and his own experience as a dishwasher at the same restaurant.

“DoorDash exists today to empower those like my Mom who came here with a dream to make it on their own,” Xu wrote. “Fighting for the underdog is part of who I am and what we stand for as a company. Having spoken to countless merchants since DoorDash’s founding in 2013—from a mom-and-pop store like Oren’s Hummus to the general managers of Chili’s—I am humbled by their relentless drive to create and build, and their contribution to their communities … helping brick-and-mortar businesses compete, succeed, and flourish in these rapidly changing times is the core problem we are trying to solve.”

DoorDash added that it aims to “get 1 percent better every day” in the months and years ahead. While that is an impressive goal and a rallying call for prospective investors, the company will now face the increased scrutiny that comes with being a publicly traded entity—and significant executive pressure to finally become profitable and, from that point forward, post improving financial metrics with each quarterly earnings report.

The company outlined a range of risk factors that could derail or delay those goals, including its ability to accurately forecast revenue and plan operating expenses, increasing and retaining its merchant population, competing with existing and future competitors, expanding its business in existing markets and new geographies, general macroeconomic fluctuations, maintaining the value of its reputation and effectively managing costs related to its delivery drivers, among others.

As the other publicly traded giants in the U.S. delivery space, Grubhub and Uber Eats have shown those pressures aren’t easy to weather, even as they all predict significant profits if the delivery market plays out like Amazon’s retail conquest.